What do you think of when you hear the words “Social Security”? Most people think of retirement benefits and not much else. But there’s so much more.

Social Security is one of the most talked-about government benefits, yet people seem to know very little about it. In a recent study, 47 percent of Americans over 50 failed a basic true/false quiz on Social Security retirement benefits. It’s something we all pay into and can claim once we’re retired … but what else?

It might surprise you to learn that Social Security encompasses way more than retirement benefits. Here are 5 surprising facts you didn’t know about Social Security.

1. Spousal Benefits Aren’t Only for Current Spouses

Before we dive into who else qualifies for spousal benefits (spoiler alert: Widows and divorcees), let’s talk about spouses with no earned income.

If You Have No Earned Income

If you’re married and don’t have a work history (because you stayed home to raise children, for example), you may think you don’t qualify for Social Security benefits. But guess what? You actually do qualify for benefits (pending you meet some criteria).

As long as your spouse is over the age of 62 and is already receiving benefits (either retirement or disability), you can apply for spousal benefits. If approved, you can receive up to 50 percent of your spouse’s benefit amount.

If You’re Divorced

If you’re divorced and your ex-spouse passes away, you can claim spousal benefits. The requirements? You were married to each other for at least 10 years, have been divorced for at least two years, and aren’t remarried. (You can still apply for benefits if your ex-spouse remarried.)

If You’re Widowed

Widows and widowers are also eligible for spousal benefits. If you haven’t reached full retirement age at the time of your spouse’s passing, you’ll receive reduced benefits. Once you hit retirement age, you qualify for full benefits.

Keep in mind, if you remarry before age 60, you no longer qualify for spousal benefits as a widow or widower. If you remarry after age 60, your spousal benefits aren’t affected.

Have questions about Social Security? PAX Financial Group regularly hosts free workshops to discuss these benefits in more detail. Click here to visit our events page and register for the next event.

2. Your Benefits are Subject to Taxes

In retirement, there are three main sources of income: Retirement accounts, investment accounts and Social Security. And while you may be prepared to pay taxes on the first two, did you know you may also have to pay taxes on your Social Security benefits?

It’s true. Social Security could tax up to 85 percent of your benefits. And if you live in one of these 13 states, your benefits could be subject to state taxes too. (This does not include Texas.)

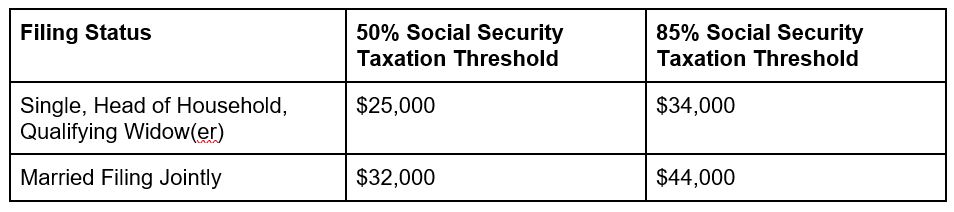

But just how much tax are we talking about? Take a look at the chart below. If your income is at or above this threshold, your benefits may be subject to federal tax.

Under most circumstances, only those who rely solely on Social Security in retirement fall below these thresholds. This means the Social Security tax is something you’ll need to account for in your retirement planning. Make sure to discuss your Social Security benefits with a financial advisor who really understands how these benefits work.

3. You Can Receive Benefits Before You Retire

You can claim Social Security benefits anywhere from age 62 to age 70. Your full retirement age (the age at which you can start receiving full retirement benefits) is based on the year you were born.

If you claim benefits before your full retirement age, they’re reduced. If you wait until after your full retirement age, they increase.

But what if you haven’t reached full retirement age, are still working and want to receive benefits?

You can still claim Social Security benefits in this scenario, but your earnings are subject to the Social Security earnings test. This test prevents people from simultaneously collecting full retirement benefits while also collecting money from a job. Depending on your age and income, Social Security could withhold up to $1 in benefits for every $2 in earned income.

Once you reach full retirement age, you can receive full benefits.

4. Social Security Pays Benefits After They’re Due

Social Security pays benefits in the month after they’re due. For example, you will receive January benefits in February, February benefits in March, and so on. It’s important to keep this in mind as you decide when you want to start your benefits. If your goal is to receive benefits starting in September, for example, you’ll need to technically start them in August (the month before) so that you actually receive the money in September.

5. There’s More to Social Security Than Retirement Benefits

Most people only think of retirement benefits when they think of Social Security, but there’s actually more to it than that. In addition to retirement benefits, Social Security also provides:

- Disability benefits, such as Supplemental Security Income (SSI) or Social Security Disability Insurance (SSDI)

- Medicare health insurance for those over the age of 65 or with a disability

- Death benefits paid to the spouse or child of a deceased worker

- Benefits paid to the dependents of retired or disabled workers

- Benefits paid to the dependents of deceased workers

The Bottom Line

There are a lot of moving pieces to this Social Security puzzle. And at PAX Financial Group, we get a lot of questions about them! While I wouldn’t recommend relying solely on your Social Security benefits in retirement, it’s a good idea to prepare early to maximize these benefits for the long term.

If you think you may qualify for any of these benefits, speak with a financial advisor about how you can take advantage of these resources. Knowing the basics of how this program works puts you ahead of the curve (remember, 72 percent of people failed a basic Social Security true/false quiz), and can help you make smarter financial decisions down the road.

At PAX Financial Group, we specialize in retirement planning and welcome the opportunity to help you tackle the complexities of Social Security. Whether you need help understanding Social Security basics or strategizing the best age to start claiming benefits, we’re here to guide you every step of the way. Contact our office today to learn more about how we can help you plan for the best retirement imaginable.

This material is provided by PAX Financial Group, LLC. The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. The information herein has been derived from sources believed to be accurate. Please note: Investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. All economic and performance data is historical and not indicative of future results.