Research shows that nearly 75 percent of Americans have gone into debt to pay for a vacation, with the debt averaging $1,108.

You likely have one of two reactions to this news: “Holy Cow!” or, “Yeah, I’m one of them.”

The truth is, vacations are expensive. And many people spend even more money because of peer pressure. Whether your child’s entire class is going to Disneyland and you feel the need to have your family join, or if you’re a new retiree and everyone in your retirement community is taking a river tour, adult peer pressure is a real thing. But it doesn’t mean you have to dig yourself into a financial hole to participate. With a little bit of planning, you can take that trip without breaking the bank.

Below are 8 steps to making this happen.

Start planning for your future today. Contact PAX Financial Group to see how we can help.

1. Know Your Budget

More than 50 percent of Americans don’t budget for vacations even though they take at least one a year. This can be a huge mistake. Every good vacation can be a great vacation if you come home debt-free, and this starts with a plan. So, before you pull out that credit card and start booking airfare, know your budget.

A good starting point: Look back at the last three years and calculate how much you’ve spent on vacations on average. Then, set a monthly savings goal by dividing that number by 12. For example, if you and your spouse usually spend $6,000 a year, aim to save $500 a month. That way, you’ll have the money available when the time comes for your next adventure.

2. Set Up a Travel Fund

Once you have your monthly savings goal, set up a vacation fund. You should keep this money in a separate savings account similar to your emergency fund. That way, you will have money on hand when you get the urge to go on your next adventure. And you can see exactly how much you have.

Establishing a travel fund can help you stay realistic about how much you can afford. For example, if you only have $3,000 saved up, then you know it’s probably not possible to take your spouse and two kids on that international vacation quite yet without using more than what you have saved.

A travel fund can also help keep you accountable and prevent you from piling on debt to cover your next trip.

3. Get an Idea of How Much You’ll Spend

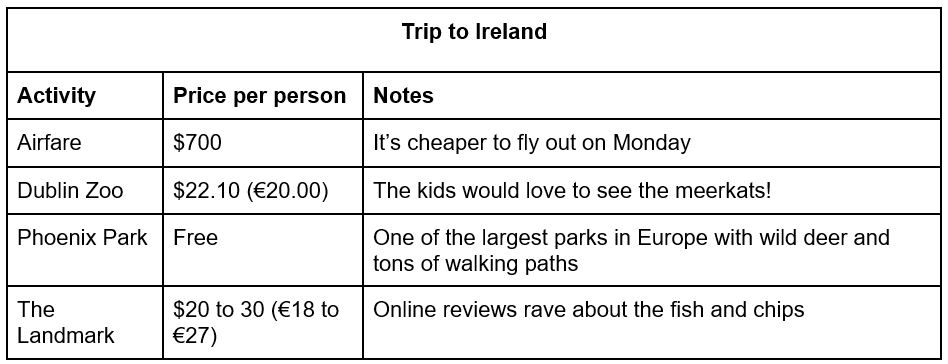

Once you’ve pinpointed your next getaway, research how much you’ll likely spend on transportation, lodging, meals and activities.

If you want to be extra prepared, enter all this information into a spreadsheet so you can easily see how much money you’ll need.

Here’s an example of what that could look like:

You don’t have to list out every single thing you want to do. But doing your research ahead of time can help you set realistic goals about what you can and can’t afford.

4. Decide if You Can Realistically Cut Costs

No one knows you better than … well, you. Think about what type of traveler you are. Do you usually stay somewhere with a kitchenette so you can cook most of your meals at home? Or do you prefer to try as many local restaurants as you can? Will you give into adult peer pressure if going with other people?

How ever you are, be honest with yourself about how much you’ll spend on your trip. Can you cut costs in any way? Will you really want to?

If you don’t have enough money saved to pay for your trip in full, consider postponing it until you do. This may not be ideal, but it can be better than coming home to a large credit card bill that will take you months (or years) to pay off.

5. Pay Attention to Extra Fees

Before you book your flight or lodging, read the fine print to see what fees are included. Just because the base price may look like a better deal, it may not actually turn out that way once extra fees are added in.

For example, let’s say you’re thinking about taking a budget airline. The price probably looks much cheaper than all the others. But after reading the fine print, you may realize that nothing is included. You’ll have to pay extra for luggage, snacks, the ability to pick your seats and more. After crunching the numbers, you may realize you’d actually save more money by going with another airline.

The same goes for Airbnbs. Sometimes a rental property looks like a great deal, but the price per night is nearly twice as much once you factor in cleaning fees, service fees and occupancy taxes.

The point? Pay attention to the details when you’re in the thick of planning. The last thing you want is a bunch of hidden fees eating up most of your budget.

6. Don’t Wait Until the Last Minute

While a little bit of spontaneity can be good, booking a trip well in advance can save you money, especially if you’re flying. According to a recent Skyscanner report, the best time to book a trip is 30 days in advance for domestic travel and four months in advance for international travel.

Increase your savings potential by staying flexible with your travel days. It can be cheaper to fly on a Tuesday, Wednesday or Saturday, for instance.

7. Use Credit Cards Wisely

Credit card rewards and bonus miles can be a great way to fund your next vacation, but only if you pay your balance off in full each month. Credit cards can be more hassle than help if you’re left with a lot of debt.

If you do pay your cards off each month, consider opening a travel rewards credit card with a decent sign-up bonus. Then, use your bonus toward your flight or hotel. This is called “travel hacking” and it’s an easy way to fund your next trip (but only if you’re smart about it).

8. Know Your Exchange Rates (if Necessary)

Exchange rates can play a huge role in how much you’ll actually spend on a vacation. If you’re traveling abroad, research the rates ahead of time so you’ll know what to expect.

Let’s say you decide to take that trip to Ireland. Based on current exchange rates, one euro equals $1.10 in U.S. dollars. So, if you bought a souvenir for €200 in Dublin, it’d actually cost you $220.98 (slightly more than it seems).

The opposite could happen if you bought a $200 item in Canada, where one Canadian dollar currently equals $0.76 in U.S. dollars. In this case, you’d only spend $152.21.

How We Can Help

Taking a much-needed vacation shouldn’t leave you with a pile of debt. At PAX Financial Group, our mission is to help clients make smart decisions with their money. No matter where you are on your journey to financial security, we’d be happy to look over your specific situation and answer any questions you may have. To learn more about our services, contact us today.

This material is provided by PAX Financial Group, LLC. The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. The information herein has been derived from sources believed to be accurate. Please note: Investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. All economic and performance data is historical and not indicative of future results.