Retirement Planning in San Antonio

IT'S NEVER TOO EARLY OR LATE TO START PLANNING FOR YOUR FUTURE.

As Benjamin Franklin once said: “If you would be wealthy, think of saving as well as getting.”

Many factors come into play when considering when to retire in San Antonio. This Quick Guide is intended to help identify some of the most important retirement planning components to consider before you retire.

Here at PAX Financial Group, we’re all about creating a warm and welcoming environment for our fellow San Antonians and new friends relocating from different parts of the United States. Retirement planning in San Antonio comes with its unique challenges – varying living costs and region-specific estate and tax planning rules.

Our team has years of experience helping clients with retirement planning, investment management, financial advice, estate planning, and insurance. We’ve been privileged to assist hundreds of individuals and families in transitioning smoothly to this exciting new chapter in their lives.

When Can I Retire?

As the old saying goes, “Timing is everything.” Determining the ideal time to retire is pivotal because this decision can impact your lifestyle and financial security in your late retirement years.

As the old saying goes, “Timing is everything.” Determining the ideal time to retire is pivotal because this decision can impact your lifestyle and financial security in your late retirement years.

To help with this, consider collaborating with a San Antonio financial advisory firm specializing in retirement planning. They can assist you in creating a retirement plan that factors in things like your current age, the age you plan to retire, your total savings, your expected annual retirement expenses, your expected retirement income, and a realistic rate of return on your investments.

For example, a comprehensive retirement plan should consider your risk tolerance and the volatility of your investments, as market downturns can significantly impact your retirement assets and income. Consider factors such as life expectancy and healthcare costs, because both impact your retirement expenses.

In addition, you should pay attention to the impact of inflation on your purchasing power over extended periods.

Lastly, consider the potential benefits of delaying your retirement date because doing so can increase your Social Security benefits and give your investments more time to grow. Careful planning and strategic decision-making are essential to pursuing a secure, comfortable retirement.

Why PAX? At PAX Financial, retirement is not a closing chapter but an exciting new start. We call this transition PIVOTING. We aspire for you to retire and to PIVOT into a fresh and stimulating phase of your life.

Our unique PIVOT Retirement Planning™ system is designed to do more than just prepare our clients for retirement. We aim to ensure you are ready in all aspects of your life—financial, emotional, and physical. We envision your retirement as the most enriching time, full of anticipation and joyous minutes, days, weeks, months, and years.

What Do I Do Right Now? New Book Looks at Money and Retirement at Any Age

Why a Long-Term Relationship with Your Advisor Can Help You Build Wealth

Retirement Investing Strategies

Investing for retirement is a critical financial strategy that can significantly impact the quality and comfort of your post-retirement years. With people living longer and healthier lives, your retirement could last as long or even longer than your working years. Consequently, it's important to understand how to maximize your financial resources during this period.

Investing for retirement is a critical financial strategy that can significantly impact the quality and comfort of your post-retirement years. With people living longer and healthier lives, your retirement could last as long or even longer than your working years. Consequently, it's important to understand how to maximize your financial resources during this period.

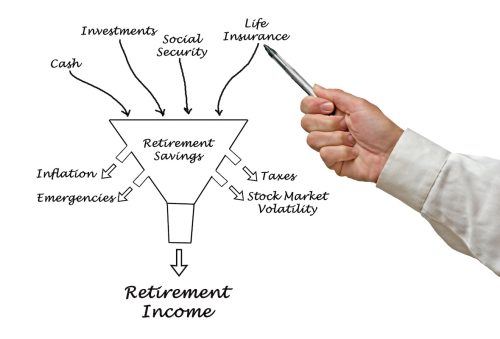

Retirement investing strategies involve a comprehensive and systematic approach to saving, investing, and growing your wealth over time, helping you pursue financial independence when you're no longer drawing a work-related paycheck.

One optimal investment portfolio strategy for high-net-worth individuals (HNWIs) is the power of diversification. Diversification should effectively lower risk by minimizing the impact of any single investment's poor performance on the overall portfolio. The precise allocation would depend on the investor's risk tolerance, time horizon, and financial goals.

Risk and Reward: Striking the Optimal Balance

The ultimate aim of any investment strategy is to achieve an optimal balance between risk and reward. For HNWIs, this is especially crucial as they often have more complex financial goals and longer investment horizons. Therefore, an investment strategy should be tailored to accommodate their specific needs.

Rebalancing:

A sound investment strategy should incorporate regular portfolio reviews and rebalancing to ensure the current asset allocation aligns with your goals as market conditions and personal circumstances evolve with time.

Why PAX? Being a wealthy and prosperous individual necessitates a tailored strategy for handling your investments to maintain a robust investment portfolio. As your income and assets grow, the importance of having a prudent and efficient plan for supervising, strategizing, and correctly allocating your assets in alignment with your risk tolerance becomes even more critical. Our team at PAX Financial boasts considerable expertise in managing assets for high-net-worth clients and offers various services that could appeal to your financial needs.

A 401(k)-to-Roth Conversion: When it Makes Sense, and When it Doesn't

Two Key Retirement Strategies for San Antonio Residents in Their 50s

Retirement Tax Planning

“Retirement is not the end of the road. It’s the beginning of the open highway.”

As you near the end of your career, odds are that you have accumulated a substantial amount of savings. While this is good news for your retirement plans, protecting those assets is even more important, especially once your income reduces. There are better times to be paying large tax bills than post-retirement!

This section highlights the importance of consulting with a reputable, experienced tax planning financial advisor in San Antonio. Here are some of the most common retirement tax planning strategies for pre-retirees and retirees:

- Maximize Tax-Advantaged Retirement Accounts: The most common retirement tax planning strategy is maximizing contributions to tax-advantaged retirement accounts like 401(k)s, IRAs (Traditional and Roth), and Health Savings Accounts (HSAs). The contributions you make to these accounts are often either tax-free or tax-deductible, which can lower your taxable income now or in the future.

- Develop a Strategic Withdrawal Order: This strategy identifies which savings and retirement accounts you will draw from to minimize your tax exposure. For example, it's beneficial to withdraw from taxable accounts first, tax-deferred accounts (like traditional 401(k) and IRA) second, and tax-free accounts (like Roth IRA) last.

- Roth IRA Conversions: Converting a traditional IRA to a Roth IRA can provide tax-free income in retirement. While the conversion triggers a tax liability in the year of conversion, it can be beneficial in the long run, especially if you expect to be in a higher tax bracket in retirement.

- Tax-Loss Harvesting: San Antonio financial planners may suggest tax-loss harvesting to offset capital gains tax liabilities. This involves selling securities at a loss to offset a capital gains tax liability.

- Asset Location: It's important to consider the type of investments in taxable versus tax-advantaged accounts. Income-generating investments may be better placed in tax-deferred accounts, while growth-oriented investments might be more appropriate for taxable accounts.

- Charitable Contributions: Donating to charity can not only be personally satisfying, but it can also provide tax deductions. For example, if you are older than 70½, you can make a Qualified Charitable Distribution (QCD) from your IRA, which can satisfy your Required Minimum Distribution (RMD) and isn't considered taxable income.

- Gift and Inheritance Tax Strategies: Implementing strategies to mitigate estate tax can also be a key component of retirement tax planning. This could involve gifting assets during your lifetime or setting up trusts.

Why PAX? Our experienced tax planning professionals are committed to maintaining complete transparency and providing comprehensive responses to any inquiries you might have. Our goal is to tailor a tax plan that effectively addresses your needs and is strategically structured to pursue your financial targets.

4 Ways to Retire: Which is Right for You?

4 Things Pre-Retirees Worry About Most- and What to do About it

Retirement Income Strategy

Before you retire, understanding exactly what your income stream will look like is of utmost importance. If you don’t have enough income to support your planned lifestyle, you either need more income or you may need to adjust your standard of living once you no longer can rely on a paycheck.

Before you retire, understanding exactly what your income stream will look like is of utmost importance. If you don’t have enough income to support your planned lifestyle, you either need more income or you may need to adjust your standard of living once you no longer can rely on a paycheck.

Creating a plan for generating income during retirement involves a multi-faceted approach that can draw on various income streams. The more traditional retirement income sources include Social Security, pensions, and annuities - all of which provide a fixed, predictable income.

With the rising cost of living, inflation, and increased longevity, you may need more than these traditional sources. Consequently, planned withdrawals from investment accounts, such as 401(k)s and IRAs, will become an important part of your retirement income planning efforts.

Investment accounts not only serve as a significant income source but also offer potential for growth, thereby helping to counteract inflation over the retirement years.

You can include stock dividends, interest from bonds, or rents from real estate properties and/or other types of alternative investments.

Why PAX? At PAX Financial Group, our emphasis on investment income allows high-net-worth retirees to maintain their lifestyle without significantly depleting their principal.

5 Surprising Facts You Didn’t Know About Social Security

One Tip That Can Help You Avoid Retirement FOMO

You've Made it to Retirement! How a Financial Advisor Can Help With the Transition

Retirement Cost of Living Expenses

Regardless of your financial status, planning for your ongoing cost of living during post-retirement years is a necessary part of the retirement planning process. Once you understand your retirement income stream, you can address your cost of living expenses.

Regardless of your financial status, planning for your ongoing cost of living during post-retirement years is a necessary part of the retirement planning process. Once you understand your retirement income stream, you can address your cost of living expenses.

According to a recent report, San Antonio is 8% lower than the national average. This includes:

- 11% lower grocery costs than the national average

- 11% lower utility costs than the national average

- 20% lower housing costs than the national average

Remember, healthcare costs rise as we age, and the potential for inflation means the cost of goods and services will likely increase, eroding savings.

Why PAX? At PAX, our core tenets include:

- Engaging in open and genuine dialogue with our clients

- Focusing on your individual needs beyond simply managing your investments

- Applying a well-established method for managing wealth

- Adhering to principles of integrity, openness, and responsibility

- Acting as financial guardians who, as fiduciaries, consistently prioritize your interests

- Maintaining a clear and uncomplicated fee structure

Risk Management

“It’s better to be safe than sorry.”

Insurance coverage is another important retirement planning component as you age after your retirement years.

Whether it's life insurance, long-term care, liability, or property insurance, these forms of coverage can play a critical role in your overall risk management efforts. They protect against unexpected losses due to accidents, illness, or damage and provide a safety net for your loved ones, helping reduce financial stress during life's most challenging times. Insurance is more than just a policy; it's a proactive approach to managing life’s uncertainties and pursuing a financially stable future.

An essential aspect of risk management that San Antonio wealth managers prioritize is the regular reassessment of your insurance needs. As life changes, so do your insurance needs. You might purchase a new home, start a family, launch a business, or approach retirement - all these transitions necessitate a review and likely adjustment of your insurance coverage. Adequate coverage should evolve with your circumstances,

Why PAX? Assessing your current insurance coverage is vital to our retirement planning services. Our experienced financial planners at PAX Financial are here to guide you in choosing the optimal coverage tailored to your specific needs. We make sure that your insurance requirements are adequately addressed.

Charitable Giving Retirement Strategies

As you achieve increasing wealth, one way to share in your success is by contributing to meaningful causes for you and your family. Not only are you supporting charities that you believe in, but you can also leverage important tax benefits by utilizing a charitable giving retirement strategy.

As you achieve increasing wealth, one way to share in your success is by contributing to meaningful causes for you and your family. Not only are you supporting charities that you believe in, but you can also leverage important tax benefits by utilizing a charitable giving retirement strategy.

Charitable trusts, donor-advised funds (DAFs), and foundations are common vehicles for these contributions:

- A charitable trust allows individuals to donate appreciated property but retain some rights (an income stream for the lives of both spouses) to the donated assets for a specified period, providing potential income, estate, and gift tax benefits.

- DAFs offer a flexible way to donate, allowing individuals to contribute to the fund and receive an immediate tax deduction, then recommend grants to their chosen charities over time.

- In addition to these advantages, establishing a foundation provides a structured and enduring way to impact chosen causes significantly.

- A private foundation, though more complex and costly to establish than a DAF or a trust, offers high-net-worth individuals greater control over their charitable activities and can act as a family legacy.

These giving strategies can also yield substantial tax benefits, including reducing estate tax liabilities, providing income tax deductions, and mitigating capital gains taxes.

Why PAX? By strategically integrating charitable giving into retirement planning, you can align your financial goals with your philanthropic values, creating a lasting legacy while optimizing your assets.

A Retirement Checkup for Employers: 3 Perks to Consider as People Return to Work

Planning a San Antonio Retirement? 5 Considerations When Choosing Where to Retire

Is it Expensive to Live in San Antonio Texas? How Long Will Your Retirement Funds Last?

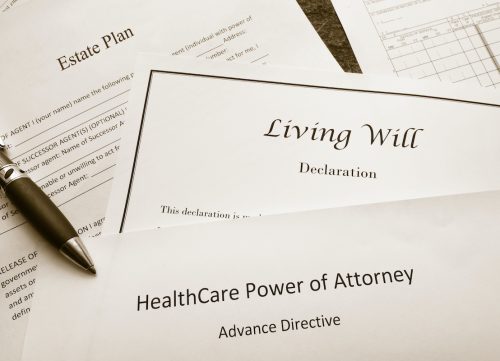

Estate Planning Strategies

Estate planning provides a roadmap for the distribution of your assets after both spouses pass on. The plan also intends to minimize any tax implications on your designated heirs.

Estate planning provides a roadmap for the distribution of your assets after both spouses pass on. The plan also intends to minimize any tax implications on your designated heirs.

A comprehensive estate plan should include a comprehensive will or trust

- A well-constructed will is fundamental in ensuring your assets are distributed according to your wishes

- A trust can provide additional benefits, such as avoiding probate, providing for minors or special needs dependents, and provide potential tax benefits.

- Additionally, keeping beneficiary designations updated on life insurance policies, retirement accounts, and other financial products is essential, as these designations typically supersede instructions in a will.

Another significant estate planning strategy in retirement involves reducing the size of your taxable estate to minimize estate taxes. Gifting strategies can be employed, including annual gifts to children or grandchildren or charitable contributions.

More advanced strategies like establishing a Family Limited Partnership (FLP) or a Charitable Remainder Trust (CRT) should be considered by higher-net-worth individuals.

Another estate planning tactic could be owning life insurance within an Irrevocable Life Insurance Trust (ILIT), which can provide liquidity to pay estate taxes and protect your estate's value.

Why PAX? It's important to remember that estate planning is not a one-time event but an ongoing process that should be revisited regularly to ensure that it stays aligned with changes in your circumstances, current tax laws, and your retirement goals. We provide outstanding customer service to our clients; you’ll never be just a number to us. We believe in having honest conversations with you.

Why a Financial Checkup is So Important for Good Retirement Planning- San Antonio

This material is provided by PAX Financial Group, LLC. The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. The information herein has been derived from sources believed to be accurate. Please note: Investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. All economic and performance data is historical and not indicative of future results.