Some of the best opportunities to save money and build wealth reside in the art of tax mitigation. As a San Antonio, TX, financial advisor, we are here to help you understand and implement tax mitigation strategies. It’s time to make your annual income tax liability work to your advantage.

The Primary Goal Of Any Effective Tax Planning In San Antonio, Tx, Is To Lower Your Overall Taxes And Keep More Money In Your Pocket. Use This Quick Guide To Cover All Your Bases.

Tax-paying households deserve to keep as much of their hard-earned income as possible, so take note of these tips and reach for help to take action. This article covers:

- Using dividends

- Selecting and managing the right IRA

- Harvesting tax losses

- Making charitable donations

- Estate planning

Dividends may be taxed at a lower rate

Dividends are a form of income you receive from investments, such as stocks and bonds. They are taxed whether you reinvest them or receive them. However, some qualified dividends may be taxed at lower rates versus unqualified dividends. You may also be able to reduce your tax burden if you place your dividend-earning investments in certain tax-advantaged accounts such as IRAs and/or 401k plans.

As always with taxes, it’s essential to consult with an expert before making any big decisions about how you handle your finances. Why? Because you don’t want to end up paying more than necessary on taxes and penalties when it comes time for filing returns.

Using a 401(k) plan can help cut down your tax bill

As you may well know, a 401(k) plan is a type of qualified retirement plan that allows employees to defer paying income taxes on their earnings until they withdraw the money. The benefit of this deferred taxation is that your money grows faster because it isn’t being taxed as often, which means you’re able to save more for retirement.

Here’s the catch:

- If you are under the age of 59½ and withdraw funds from your 401(k) before reaching retirement age, you will be subject to income tax on those funds plus a 10% penalty.

- If you’re younger than 50 years old at the time of withdrawal and have not yet met IRS requirements for early distribution from your employer’s plan, then there may be penalties assessed by both parties (your employer’s 401(k) provider and/or federal government).

To avoid these penalties altogether, consider using other savings vehicles such as a Roth IRA or Traditional IRA instead of withdrawing directly from your employer’s plan early.

Read: Pros And Cons Of Roth Ira Conversion In Texas

Select an individual retirement account (IRA) to reduce your annual income taxes to save money for retirement

An individual retirement account (IRA) is a type of savings account you can open that allows you to invest for your retirement. IRAs come in two types: traditional and Roth. Traditional IRAs offer upfront tax savings and tax-free withdrawals in retirement; Roth IRAs do not offer any upfront tax savings but allow for tax-free withdrawals in retirement.

There are limits on how much you can contribute each year:

- The limit for most is $6,000 if your filing status is single, head of household or married filing separately (only filing because one spouse cannot file due to being claimed as a dependent by someone else

- The limit is $7,000 if your filing status is married filing jointly or qualifying widow(er), or you are over 50

- You can make an additional contribution up to $1,000 ($2,000 total) if both spouses meet the requirements (if not yet ages 70½ ).

Harvest tax losses to mitigate taxes

Losses can be used to offset gains. You might have a large capital gain this year, but if you have sustained losses for the past several years, you can use those losses to offset that gain and reduce your taxes. This is called “harvesting” the loss by taking it in a year when it’s beneficial for you.

Losses can be used to offset gains. You might have a large capital gain this year, but if you have sustained losses for the past several years, you can use those losses to offset that gain and reduce your taxes. This is called “harvesting” the loss by taking it in a year when it’s beneficial for you.

- Losses can be carried forward.

- Losses can be used in other years as well.

Make charitable donations to help lower your income taxes

To help reduce the amount of taxes you owe, consider donating money to a charitable organization that you are proud to support. Charitable donations are tax-deductible and can be made in many ways, such as donating cash or property to a qualified charity.

Donating cash to an organization that is tax-exempt means that the donation can be deducted from your income on your taxes if specific requirements are met. The most common types of charities include: religious organizations, educational institutions, and non-profit organizations providing general interest services.

Donating property such as real estate or personal items like clothing or furniture also helps reduce your taxable income if done right! For example: If you donate a computer worth $3,000 to Goodwill Industries International Inc., they’ll give you an acknowledgment letter stating what they received from the donation, which should be kept for tax purposes.

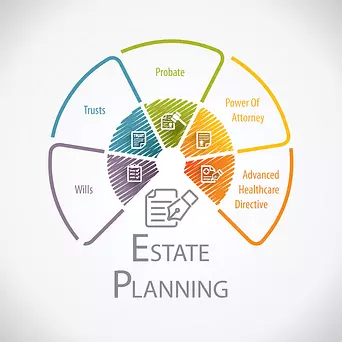

Estate planning is a vital aspect of tax planning at the professional level

Because every family and life situation is different, it pays to have a personal financial advisor in San Antonio that understands your values, wishes, and goals. If you don’t manage your estate with care, you could be faced with some pretty high taxes when it comes time for your estate to go through probate. If you don’t select beneficiaries to inherit your estate, loved ones may have to foot the bill.

Because every family and life situation is different, it pays to have a personal financial advisor in San Antonio that understands your values, wishes, and goals. If you don’t manage your estate with care, you could be faced with some pretty high taxes when it comes time for your estate to go through probate. If you don’t select beneficiaries to inherit your estate, loved ones may have to foot the bill.

Read: Common Estate Planning Questions: How To Pass A Business On To The Next Generation

Tax planning is one of the main reasons why people hire a San Antonio TX financial advisor

Tax planning in Texas is not just for the wealthy, it’s for everyone who files. There are more tax-saving ideas to expound on together, such as claiming appropriate tax deductions for business expenses or making strategic investments such as real estate.

The first step in any successful tax plan is to determine your goals and then set up an annual budget so that you know how much money it will take to reach those goals. So, if you are looking for a way to reduce your tax bill, we recommend that you work with an experienced San Antonio, TX, financial advisor who serves as a fiduciary. Our team at PAX is here to help create a strategy designed specifically for your situation and needs.

Tax planning in Texas is a great way to practice and call in more financial abundance. Are you ready? Give us a call!

This material is provided by PAX Financial Group, LLC. The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. The information herein has been derived from sources believed to be accurate. Please note: Biblically Responsible Investing(“BRI”) involves, among other things, screening for companies that fit within the goal of investing in companies aligned with biblical values. Such screens may serve to reduce the pool of high performing companies considered for investment. Investing involves risk. BRI investing does not guarantee a favorable investment outcome. PAX Financial Group has conducted due diligence for their Biblically Responsible Investing (BRI) process and proudly serves as each client’s advocate using fully vetted third-party specialists for the administration of BRI methodology. Past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This information should not be construed as investment, tax, or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product and should not be relied upon as such.