Estate Planning San Antonio TX

While it might not be the most fun thing to do in the world, estate planning could very well be one of the most important. Sure, planning a vacation or deciding on weekend plans is certainly more enjoyable, but dividing up your assets and ensuring a smooth process after you’ve passed can save your loved ones a major headache in the future. All of the money, real estate, and other assets you’ve built deserve to be passed down appropriately according to your wishes.

Despite what you may think, estate planning is hardly just for the affluent. Even if you don’t have large investment accounts or a valuable home to pass on, leaving your loved ones without a solid plan for your assets could result in costly, time-consuming processes that may result in them receiving nothing at all. If you’re not convinced of the importance of estate planning or are on the fence, use this article to understand why it is one of the most important financial decisions you will make in your life.

In this article, we will explore:

- What estate planning is and why it is necessary

- Who should be included in your estate planning

- The tools, resources, and people that can help make the process easy and mistake-free

- Common mistakes to avoid when estate planning

- When you should start estate planning, and how often you should update your plan

What is Estate Planning?

The word "estate" may be misleading and invoke images of a large manor or residence, making you feel as if you do not have an estate, as it appears it is only for the affluent. This could not be further from the truth. Nearly everyone has an estate, which is comprised of everything you own, such as: your car, home, any real estate you own, bank accounts, life insurance, furniture, and other personal possessions. Regardless of how vast or modest your estate is, you cannot take it with you when you die. Therefore, there is a need for estate planning.

When you pass away, which is inevitable, you most likely would like a say in how your former possessions are divided up amongst your loved ones or even certain organizations you cherish. To ensure that your final wishes are carried out, you should provide detailed instructions on how to divide your assets up, who is to receive them, and when.

Of course, you will want this to be done while also paying the least amount in taxes, court costs, and other legal fees. This is what estate planning is: you make a plan in advance and name the people or organizations you want to receive your assets upon your death, making the process as easy as possible after you pass. Of course, good estate planning is comprised of much more than that.

The word "estate" may be misleading and invoke images of a large manor or residence, making you feel as if you do not have an estate, as it appears it is only for the affluent. This could not be further from the truth. Nearly everyone has an estate, which is comprised of everything you own, such as: your car, home, any real estate you own, bank accounts, life insurance, furniture, and other personal possessions. Regardless of how vast or modest your estate is, you cannot take it with you when you die. Therefore, there is a need for estate planning.

When you pass away, which is inevitable, you most likely would like a say in how your former possessions are divided up amongst your loved ones or even certain organizations you cherish. To ensure that your final wishes are carried out, you should provide detailed instructions on how to divide your assets up, who is to receive them, and when.

Of course, you will want this to be done while also paying the least amount in taxes, court costs, and other legal fees. This is what estate planning is: you make a plan in advance and name the people or organizations you want to receive your assets upon your death, making the process as easy as possible after you pass. Of course, good estate planning is comprised of much more than that.

Understanding an Estate Plan

- Naming an executor of the estate to ensure the terms of the will are carried out

- Setting up funeral arrangements

- Establishing a durable power of attorney (POA) to direct other assets and investments

- Potentially setting up trusts accounts in the name of beneficiaries in order to limit your overall estate taxes

- Establishing a legal guardian for any living dependents

- Creating and updating named beneficiaries on plans such as IRAs, 401(k)'s, life insurance, and any other investment accounts

- Establishing the annual gifting to qualified charitable and non-charitable organizations as named in order to reduce the taxable estate

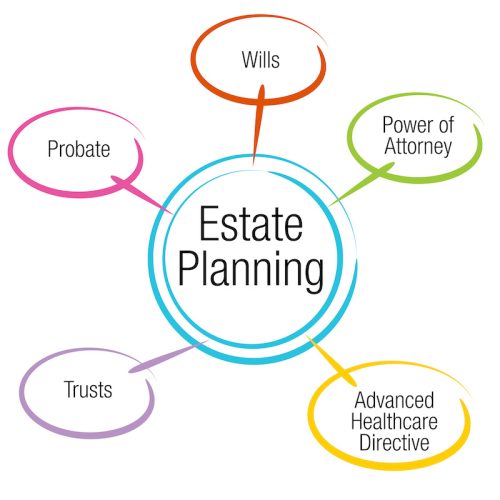

Important Estate Planning Tools

Regardless of the size of your estate, a suitable plan for your situation is needed to provide you with peace of mind. Let's go over some of the most common estate planning tools and how they can help you to create a bulletproof estate plan.

The last will and testament, or just the will, is the most common estate planning tool and only refers to the last will written before your death. If you die without a will, called intestate, much of your estate's decisions will be automatically delegated to the state's discretion. Wills must be signed, dated, witnessed, and notarized. Without a will, an executor shall be named by the state depending on who they believe is the most capable. All estates, both with wills and those that are intestate, must go through the probate process. The probate process is the greatest limitation of a will. Since it is a testamentary document that only goes into effect after death, it must be legitimized in a probate court.

A trust is a legal entity defined and established by a trust document and comprised of assets funded into it. Trusts involve a grantor/trustor who provides the assets, the trustee who manages them, and the beneficiary who receives them. Trusts are remarkably flexible, and all three aforementioned parties can be the same person. However, since we are talking about estate planning, it is highly unlikely you would leave yourself in charge of your assets and have them distributed to you after your death. Trusts serve as a way to avoid the probate process and separate specific assets from your estate before you die. Trusts differentiate from wills in that they go into effect the moment they are signed and notarized. Trusts are a great way to reduce your probatable estate by funneling your largest assets through them.

A power of attorney grants someone else the ability to make certain decisions in your name. This document limits an agent's power considerably, such as defining their role as a simple proxy for a specific deal you cannot be present for. However, durable powers of attorney can establish a much more general representation even after you are incapacitated. A durable financial power of attorney allows you to name someone to take care of any financial responsibilities if you are incapacitated. A healthcare power of attorney clearly states who your doctors should speak to in the event you are incapacitated, and a medical decision must be made.

Living wills, not to be confused with the last will, is an advance directive to any future healthcare professionals that provides them with specific guidance on your medical wishes in the event you are incapacitated.

Regardless of the size of your estate, a suitable plan for your situation is needed to provide you with peace of mind. Let's go over some of the most common estate planning tools and how they can help you to create a bulletproof estate plan.

The last will and testament, or just the will, is the most common estate planning tool and only refers to the last will written before your death. If you die without a will, called intestate, much of your estate's decisions will be automatically delegated to the state's discretion. Wills must be signed, dated, witnessed, and notarized. Without a will, an executor shall be named by the state depending on who they believe is the most capable. All estates, both with wills and those that are intestate, must go through the probate process. The probate process is the greatest limitation of a will. Since it is a testamentary document that only goes into effect after death, it must be legitimized in a probate court.

A trust is a legal entity defined and established by a trust document and comprised of assets funded into it. Trusts involve a grantor/trustor who provides the assets, the trustee who manages them, and the beneficiary who receives them. Trusts are remarkably flexible, and all three aforementioned parties can be the same person. However, since we are talking about estate planning, it is highly unlikely you would leave yourself in charge of your assets and have them distributed to you after your death. Trusts serve as a way to avoid the probate process and separate specific assets from your estate before you die. Trusts differentiate from wills in that they go into effect the moment they are signed and notarized. Trusts are a great way to reduce your probatable estate by funneling your largest assets through them.

A power of attorney grants someone else the ability to make certain decisions in your name. This document limits an agent's power considerably, such as defining their role as a simple proxy for a specific deal you cannot be present for. However, durable powers of attorney can establish a much more general representation even after you are incapacitated. A durable financial power of attorney allows you to name someone to take care of any financial responsibilities if you are incapacitated. A healthcare power of attorney clearly states who your doctors should speak to in the event you are incapacitated, and a medical decision must be made.

Living wills, not to be confused with the last will, is an advance directive to any future healthcare professionals that provides them with specific guidance on your medical wishes in the event you are incapacitated.

Common Estate Planning Errors to Avoid

While creating an estate plan is a great way to ensure a smooth process after your death, creating a plan that avoids the most common mistakes and snags is crucial. There are many important decisions when planning to protect your loved ones, but having one riddled with errors that could present legal issues will cause a ton of stress in the end.

While creating an estate plan is a great way to ensure a smooth process after your death, creating a plan that avoids the most common mistakes and snags is crucial. There are many important decisions when planning to protect your loved ones, but having one riddled with errors that could present legal issues will cause a ton of stress in the end.

Be aware of common estate planning mistakes in order to avoid them. So whether you are just starting your first estate plan or updating an existing plan, familiarize yourself with common pitfalls and mistakes so your plan can be flawless while still safeguarding your legacy.

Don’t forget to write your will: Regardless of whether or not you have written one, you have an estate plan. If you die without a written plan, the state of Texas supplies one for your estate, and you may not be too fond of it. Their decisions will be dependent upon your situation. However, it is worth noting that all of your property is not given to your surviving spouse automatically upon your death per Texas law.

Update your plan accordingly: Once you complete your plan, don't simply tuck it away and never look at it again. People move, get married, and have children; life happens. Based on these changes and the likely fluctuation of your own wealth over time, you will need to update your plan according to changes in your personal life. Laws also change and will require you to pay attention to any that are relevant to your plan.

Don’t forget to account for and plan for long-term care: The current average cost for long-term care in the state of Texas is $77,000 annually and could be a substantial element of your estate plan. Failing to plan for long-term care can end up costing you an excessive amount of money you had not planned for. Experienced estate planning attorneys help to mitigate costs and establish a concrete plan suitable to your personal needs and wants.

Don’t neglect your beneficiaries: Simply naming who your beneficiaries are is not enough due diligence to do for your named inheritants. Make sure they understand their inheritance to ensure a smooth process after your death and don't leave them out to dry. If you leave assets to a minor, you must appoint a guardian to help manage the funds until they come of age. Not doing so can result in more legal fees later on, being taken out of the estate, and can result in a higher likelihood of poor financial decisions.

Don’t sleep on the potential tax implications: Taxes are always something you will have to contend with and plan for. Tax implications can get complex, and your estate plan will be comprised of different assets, beneficiaries, wills, trusts, and other different facets. You will need to understand the different tax implications for all of them.

Should you Combine Estate and Financial Planning?

Texas Taxes and Your Estate Plan

Texas is one of 38 states that does not levy an estate tax. However, residents must still adhere to federal estate tax laws.

Texas is one of 38 states that does not levy an estate tax. However, residents must still adhere to federal estate tax laws.

There is also no inheritance tax in Texas, although other states' inheritance taxes could apply to you if someone in a different state leaves you money so that state's tax laws would be applicable then.

Texas, being the tax-friendly state it is, also has no gift tax. However, residents still must adhere to the federal gift tax, which exemption in 2022 is $16,000 per recipient.

Why Estate Planning is Important

When to Begin Estate Planning

Most advisors are going to recommend starting an estate plan as soon as possible and updating it every three to five years. While starting an estate plan when you're young-especially if you are single and without children-may seem far from your biggest priority, it is always better to start too soon rather than too late.

Regardless of when you start (preferably earlier), it is imperative to update your plan regularly around significant life events. These events can include marriage, buying a house, having children, and notable increases in your personal wealth.

Just like financial planning and investing, the earlier you start, the better. But just like financial planning, regular upkeep and maintenance are going to be required, as both plans often are comprised of many moving parts and span decades.

For help with estate or financial planning, contact one of our PAX professionals today.